Sustainable investment is when investors consider the Environmental, Social, and Governance (ESG) impacts of their investments. Clients are increasingly aware of ESG investment and what considerations we put into ethical investing, this week I detail our approach.

The premise of a sustainable investment approach is that companies that observe the best environmental, social and governance practices will outperform those that do not.

There are varying levels of commitment to sustainable investment from devotees who believe strongly that such an approach is the only way to invest, to sceptics who do not believe such an approach to investment adds significantly to an investor’s overall portfolio performance.

Wherever you sit on the continuum, sustainable investment has definitely gathered more support in recent years.

For many decades Hewison Private Wealth has advocated that where possible and cost efficient, investors own assets directly rather than via a managed fund. Initially borne out of our experience of the 1987 stock market crash, this direct approach to investment provides our clients with more predictable investment income, control over their assets, and a reduction of the influence that other investors have on our client’s assets.

Another advantage that direct investment offers is the ability to choose to avoid certain sectors of the market entirely (for example, companies that sell or manufacture armaments), or to choose to invest more heavily in certain sectors (for example, healthcare).

The alternative is to invest in managed funds or index funds, where the end investor has no control over the selection of companies for their fund and may not know what exposures they have from time to time. In addition, if other fund investors panic in a market downturn and sell their managed fund investment, the fund manager must sell assets to finance those withdrawing. In a significant sell-off, this can have an adverse impact on those investors who remain invested in the fund.

For over a decade Hewison Private Wealth have been using the services of the global research company, Morningstar, to access high quality and timely research on the companies in which we invest for our clients.

Traditionally, Morningstar’s research focussed on the cash flow of a company, the value of its assets and its likely future earnings to determine the underlying (or intrinsic) value of shares in that company. This then informs whether the shares are recommended as a good investment opportunity…or not.

Adding to this process, Morningstar now view that ESG investing is not optional for long term investors. In fact, they contend that identifying ESG risks, and estimating their impacts, is critical in properly assessing investment into the shares of a company.

While Morningstar’s equity research has always considered material risks in determining the intrinsic value estimates for shares. Formalizing this process for ESG, and incorporating it into the existing research framework, best serves investors in making informed decisions about their share investments.

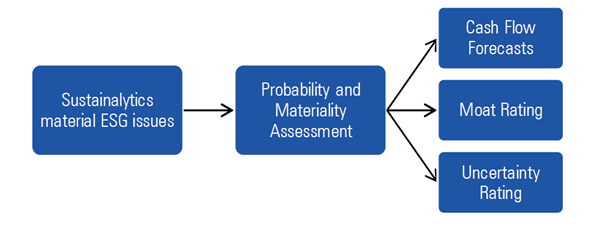

The Morningstar approach starts with using the Sustainalytics’ company-level Risk Rating, and then focusses effort on the most material ESG issues and thereby the most valuation-relevant risks. The diagram below summarises how Environmental, Social and Governance factors are incorporated throughout the research process:

Source: Morningstar

Morningstar analysts build cash flow models for the companies they are reviewing using a discounted cash flow approach. Where any ESG factors have at least an estimated 50% probability of occurrence the analysts include adjustments to the cash flow forecasts, as well as value adjustments for items such as environmental or legal liabilities. Lower probability ESG risks impact the “worst case” scenario estimates for the value of a company.

An economic moat is a structural feature that allows a firm to sustain excess profits over a long period of time. For a moat to be assigned to a company, the analysts must determine that the firm is more likely than not to generate a return on invested capital above its cost of capital.

ESG analysis plays an integral part in analysing potential value destruction threats, which then influence a company’s moat rating. Examples may include reputation risk from environmental damage, reduced consumer demand or increased costs due to social pressure, and risk to financial health arising from poor governance practices.

The uncertainty rating for a company is based on the breadth of potential future outcomes determined by the analyst. The more uncertainty about the future of a company, the more margin of safety the analyst requires before recommending the buying or selling of shares in that company.

ESG risks are factored into the uncertainty rating of a stock. For example, a company with a number of low probability ESG risks could have its uncertainty rating raised if those ESG risks could have a material impact on the company.

The Hewison Private Wealth investment philosophy remains to find quality investments for our clients at the right price and hold them for the longer term. Our client portfolios are built from the ground up to achieve each clients’ goals and objectives.

With our investment approach being long-term, risks that could impact the future value of an asset need to be considered. This includes the impact of a company’s practices in relation to Environmental, Social and Governance factors. All HPW client portfolios currently enjoy the benefits of our detailed research and investment process.

Our direct investment approach also allows our clients to avoid investment in specific sectors so that their investment portfolios align with their own ESG values.

If you are not a Hewison client and are interested in our tailored approach to investment, please give us a call to speak to one of our highly qualified advisers or contact us HERE for a discovery call back.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.