We all know the media love to paint a picture of doom and gloom, so allow me to brighten your day with a more positive view of the world.

Markets often work in mysterious ways – On Monday (7 July) of this week the U.S share market index, the Dow Jones, declined after a report was released detailing positive jobs news. That’s right, Positive! You see, positive jobs data indicates the federal reserve may not cut the official cash rate in the U.S. Traders and investors see falling interest rates as a positive for share markets, but if you ask me, as a long term investor I would much prefer to see signs of a healthy economy to drive company fundamental performance.

In Australia, the big issue for our economy has been a stagnant jobs market. Little jobs growth and zero wage growth. Job ads are down 9.1% for the year.

Businesses have not been re-investing in their people or their businesses in general. In my opinion that’s been driven by uncertainty caused by a lack of political leadership around the blueprint for future growth in Australia and of course the prospect of sweeping change had the Labor Party won the recent federal election.

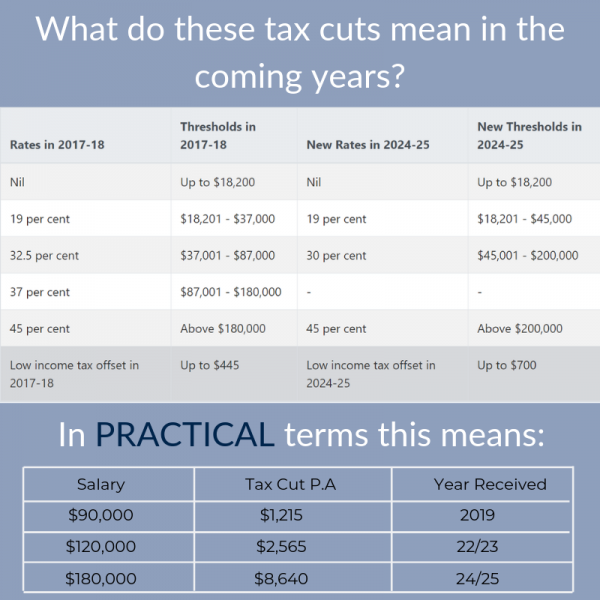

With the Liberal Party retaining Government the veil of uncertainty has been lifted and I was ecstatic to see their proposed tax cuts passed through the Senate last week. The initial response was encouraging, with 650,000 tax returns lodged in the first week of July as Aussies scrambled to receive a $1,080 cash offset.

More broadly…..

Once stage three of the tax cuts kick in, a whole tax bracket is removed. Someone earning $200,000+ p.a could save at least $11,640 p.a.

We’ve seen the RBA reduce rates by 0.5% in two months in an effort to stimulate the economy and encourage businesses to invest in growth.

My advice to homeowners is to strongly consider keeping your monthly repayments at the same level. The tax cuts will mean a larger portion of your repayment is principal and less interest. This could take years off your home loan and save you thousands in interest.

Remember, a 30-year, $600,000 home loan at 7% will cost you $840,000 in interest payments. That is staggering!

While repaying your home loan may not directly boost the economy, it provides options to redraw home equity for investment purposes in the future.

APRA’s change to the serviceability criteria that banks must apply when assessing a home loan means a typical borrower is eligible for approximately 10-20% more in borrowing capacity compared to the old rules, and this borrowing capacity will grow as interest rates continue to fall. It also means a large portion of borrowers who were recently denied credit approval would now likely be eligible for a home loan.

Of all the changes, this is likely to have the largest impact with a material increase in the amount borrowers can spend when buying a house or bidding at auction.

While some sectors of the Australian economy have stagnated in recent years, we have yet to officially fall into recession.

The fact that the RBA, Government and regulator can pull these levers in order to stimulate the economy is incredibly positive for Australians.

While interest rate cuts alone may not be enough, a combination of all of these factors should see greener pastures ahead.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.