With the popularity of exchange-traded funds (ETF) growing in recent years I thought it would be worth addressing and breaking down what an ETF is and why some investors use them in this week’s blog.

An ETF is something that you can invest in that provides you with exposure to a certain index, market sector, or managed fund that is actively managed by professionals. If you wanted to invest in the ASX200 (Australia’s 200 largest companies on the stock exchange) then you could invest in the ETF that looks to replicate this market. This is referred to as a ‘passive’ ETF and is the type of ETF that I’ll address in this blog.

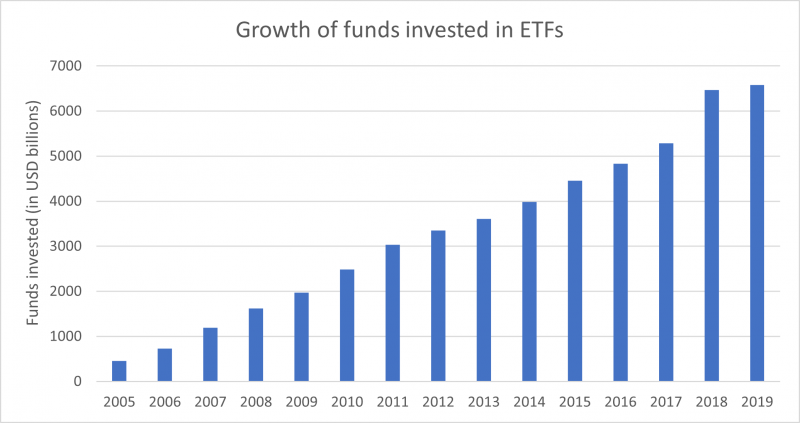

The popularity of ETFs has exploded since the early 2000s. As shown in the chart below, there was around $454 billion USD invested in ETFs in 2005. This grew to an amazing $6.5 trillion USD in 2019.

Source: ETFGI.com

Even though the most popular ETFs are those that aim to replicate the top end of the major sharemarkets around the world, as their popularity increased, so did the options available to investors.

A few examples of different market sectors that you can invest in using ETFs are:

The list goes on and on.

ETFs can be incredibly cheap, as there often isn’t much work involved. For example, if an ETF is looking to replicate the ASX200 then there is no judgement or critical thinking involved.

They also allow people to access large market sectors that they may not be able to access otherwise.

ETFs can introduce diversification to a portfolio if you don’t have a large amount to invest.

They generally replicate an index based on the size of the business. This means that for the ASX200 you wouldn’t own the top 200 companies in equal proportion, the majority of your money would be invested in the top 20 companies as they make up a significant portion of the market.

Some of the largest companies in the world stole the limelight in 2020, such as Amazon and Tesla. If you owned an ETF over the US market then you likely would have benefited from the market rally of technology companies last year. However, if those same companies have a bad run then your asset base would be significantly impacted.

When replicating an index, you have to take the good with the bad. There may be a number of companies that you would much rather leave out of your portfolio, but you don’t have that choice.

Finally, you can get caught in a ‘run on the market’. If investors lose confidence and start selling out of the market, then the manager of your ETF has no choice but to sell down the holdings in the ETF in the same proportion. This can have a snowball effect and significantly impact the value of your holding in an incredibly short period of time.

At Hewison Private Wealth we support the use of ETFs in certain circumstances when we believe it is appropriate to gain access to a particular sector of the market. However, we believe that the greatest level of control is achieved with direct ownership as that way you are the only one to decide when changes should be made to your holdings.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.