A recent report conducted by UBS Wealth Management has identified that historically low interest rates, not only within Australia but across the globe, have contributed to overheating in the property market and the risk of falling into a housing bubble.

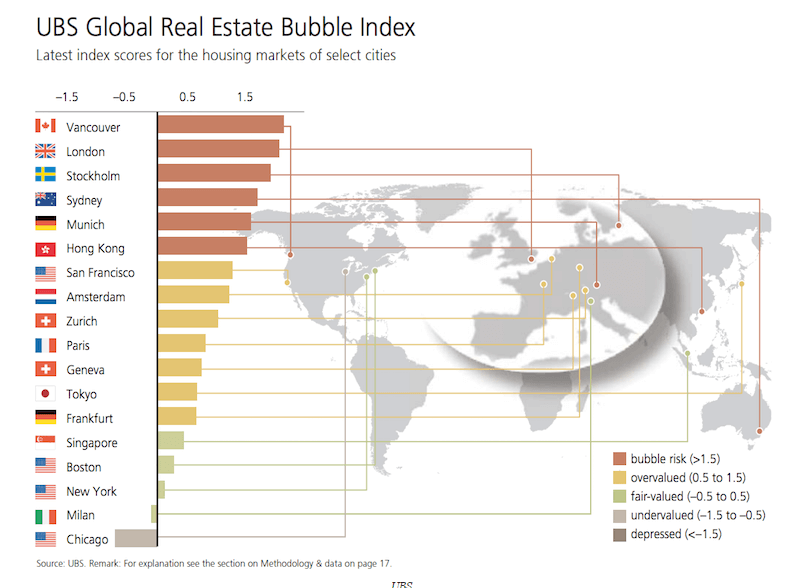

Vancouver tops the 2016 UBS Global Real Estate Bubble Index, and the risk of a bubble also seems possible in London, Stockholm, Sydney, Munich, and Hong Kong. House prices in all these cities have increased by an average of 50 per cent since 2011. Elsewhere, prices have risen by less than 15 per cent.

According to the report, Sydney’s housing market has been overheating since the city became a target for Chinese investors several years ago. In 2012, Sydney showed the lowest index score of all the covered APAC cities in 2012 – now, the market ranks in the bubble risk category and tops all other cities in the region.

The benchmarks analyse in this reports also include ‘price-to-income’ and ‘price-to-rent’ ratios. The price-to-income ratio measures the number of years a skilled service worker needs to work in order to buy a 60m² flat near the city centre whereas, the price-to-rent ratio measures the number of years a flat of the same size is required to be rented in order to complete mortgage repayments.

In London, Paris, Singapore, New York, and Tokyo, price-to-income multiples exceed 10 years and in Hong Kong, even those who earn twice the average income would struggle to afford an apartment. Further, more than half of these cities have a price-to-rent ratio above 30 suggesting they are vulnerable to a sharp correction if interest rates increase.

The chart below provides an index score which is a weighted average of multiple standardised indices across a number of major cities worldwide. A score between -0.5 and 0.5 suggests ‘fair value’, between 0.5 and 1.5 suggests ‘overvalued’ and those cities above 1.5 are a ‘bubble risk’. According to this measure, Sydney is a ‘bubble risk’ which the report advises is at “a high risk of a large price correction”.

What does this mean for you?

Only time will tell how accurate the UBS Global Real Estate Bubble Index is for predicting the future of property prices in major cities worldwide. However, a number of factors including increasing supply, higher interest rates or a crackdown on capital flowing out of China could possibly trigger a house price correction.

If you would like any further information or assistance in addressing your housing financials, Hewison Private Wealth have Client Advisors ready to help you make the best financial decisions for your future.

Any financial product advice provided is general in nature. It does not consider your needs, financial situation or objectives. You should consider the appropriateness of this advice to your circumstances before you act on it.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.