The COVID-19 pandemic is frightening and has had a catastrophic effect globally for all of us. The impact on the population at large has been severe in many aspects of our daily life including economic impacts to many of us.

I don’t intend to commentate on the global pandemic as I have no expertise. What I want to put into perspective is the likely ramifications to investment markets and peoples’ savings.

Over my 35 years’ experience in financial advising and portfolio management, I have experienced numerous market crises, crashes and corrections. Most of these have been caused by fundamental economic weaknesses which inevitably cause a major market catastrophe which persists until the weakness is corrected. Most recently the Global Financial Crisis was caused by a global credit crisis which took nearly a decade to repair.

But we tend to forget that we have experienced pandemics before including annual strains of influenza which infects the masses and kills many.

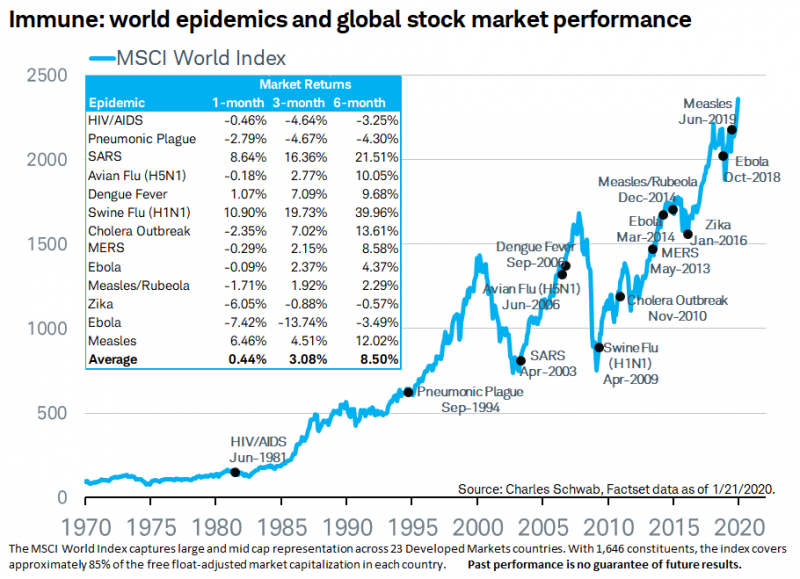

So, I looked at the MSCI World share market historic reaction to some of these previous pandemics, which are illustrated by the table below.

As you can clearly see, there have been consistently minor market declines and rapid recoveries in all cases.

But this is different. The only comparison I can make is the New York Trade Centre terrorist attack of September 11, 2001, when our world changed before our very eyes. We had never experienced anything like it, and it triggered fear and panic like never in our lifetime.

The panic triggered a global market sell-off but as people came to grips with the new age in which we live, the markets rebounded and rose higher over the next 12 months.

The financial markets hate uncertainty and fear of the unknown. Human nature drives people to sell assets in a time of fear but this is further exacerbated by automated synthetic bulk selling and short selling.

I’m no expert, but there are some logical truths about the COVID-19 virus:

So, taking all these factors into account, and the absence of fundamental economic weakness, I have an expectation of a short term (less than 6 months) market recovery, which may well be very strong.

In terms of financial considerations, the messages are – don’t panic, hold your ground and look for opportunities as the market recovers.

My gut feeling is that this experience is going to have some long-term impacts on lots of things and could well see economic benefits come out of this like of a revision of supply chains and dependence on offshore production. Watch this space.

Stay safe

John Hewison

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.