Adjusting interest rates isn’t an easy job, and the outcome is never a certainty; if it was, I guess it wouldn’t be an overly difficult decision to make.

Put simply (very simply) when the economy is booming, employment is strong, wages are increasing, and inflation is ahead of pace, then it’s likely that interest rates will increase to help keep growth ‘in check’. When things aren’t quite going to plan, and the economy is dragging, as it is now, rates will decrease to alleviate the stress placed on Australian families and companies.

There are many factors that influence the decision of the Board of the Reserve Bank of Australia (RBA) when it comes to cutting interest rates. In their recent statement, the main points supporting their decision to cut rates for the third time in five months to 0.75% include:

So, three rate cuts later, how have we and our fellow Australians responded? Arguably, not as expected.

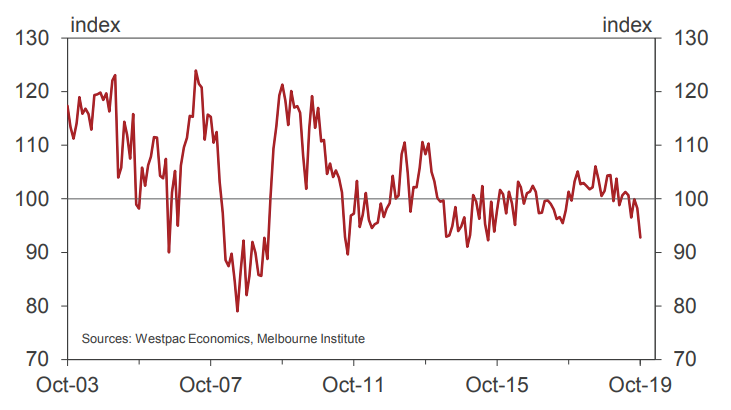

Westpac Economics produce a monthly report, the Consumer Sentiment Index, which is a statistical indicator of our economic health based on survey responses gathered from households around Australia.

The October release indicates that even after a rate cut from the RBA, which would ideally boost confidence, consumer sentiment has indeed experienced a sharp decline since September.

The below chart shows the historical results of the survey. The middle line in the centre of the chart is the benchmark for the survey, where consumers are neither overly confident nor lacking confidence in the economy.

Westpac Chief Economist Bill Evans said that “the result will be of some concern to the monetary authorities (the RBA).”

It appears that even though rates are cut, and financial pressures should be somewhat eased, people are still concerned about the economic landscape both domestically and globally.

If you are paying off a mortgage, then you would certainly be welcoming the news! Interest costs are reduced when banks pass on the rate cuts, so a great idea would be to try keep your repayments at the same level so that you are reducing a larger amount of your principal loan.

If you are a retiree or using investment income to fund your living needs, you might be wondering how you can continue to generate the cashflow you need. This may require some smarter investing and I wrote this blog a couple of months ago addressing ways to go about this.

As financial advisers, the last thing we want is for people to be feeling nervous or concerned about their own situation. There is a lot happening in the world but by taking the emotion out of your investment strategy you could help shield yourself from the noise.

If you or anyone you know might relate to this, please feel free to get in touch with us and we can help you take control of your finances and your future.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.