As you would be aware by now Donald Trump is the President-elect of the United States, winning the majority of the vote, against all odds.

It was a wild day for the Australian sharemarket yesterday, dropping four per cent at one point, as the Trump victory became certain. Investors feared a Trump victory could cause global economic and trade turmoil, alongside years of policy unpredictability. However, the market settled, recovering somewhat to end the day two per cent down.

After initial fears of further falls, the Australian market is up sharply today.

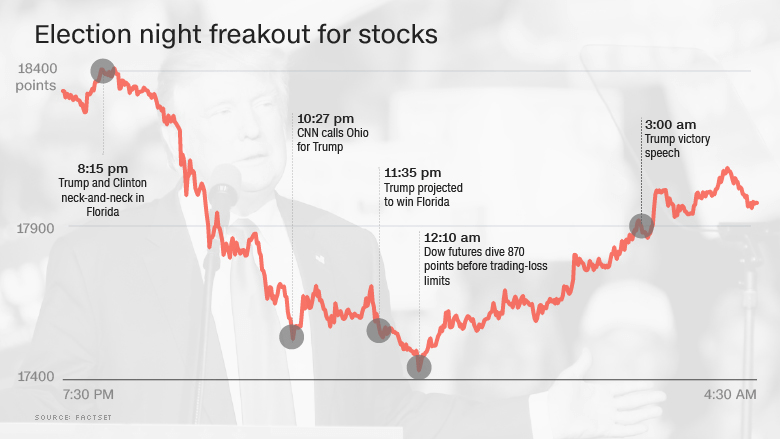

Global markets reacted in a similar vein. The US futures market initially took dive, at its worst, forecasters predicted of a decline of around five per cent upon US sharemarket open demonstrated in the chart below.

What was even more surprising was that despite fears the US sharemarket would tumble after Trump’s win, US shares actually increased 1.4 per cent, as investors rationalised Trump policies could actually be supportive of growth in the US economy. Trump’s acceptance speech is being widely credited as conciliatory in nature; raising hope that he will focus on policies that will boost the economy, putting aside some of his more extreme campaign positions. “I want to tell the world community that while we will always put America’s interests first, we will deal fairly with everyone,” he said.

Some key Trump policy initiatives:

Some of Trump’s economic policies could provide a boost to the US economy, such as tax cuts and increased defence and infrastructure spending. However, the risk is these policies could blow out the budget deficit and whilst trade sanctions could hurt growth. Although it’s still very early days, his policies need to be further understood and implemented before the impact on the economy would be felt.

Investment Takeouts

If there is any take out from this it is that markets can be volatile and highly unpredictable. This should not come as a surprise as we saw a similar reaction with the BREXIT vote earlier in the year. Market nervousness may remain in the short term, especially as Trump’s victory is further digested and his policies greater understood. However investors should hold tight rather than get caught up in a mass panic attack. Events like this remind us the importance to switch off from the day-to-day market noise and sensationalist reports but rather focus on your long-term game plan.

The information provided above is general information only and individuals should seek specialised advice from a qualified financial adviser.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.